At Spinifex Energy, we understand that financing commercial solar panels can be a complex decision for businesses.

The right financing option can make all the difference in maximizing your return on investment and achieving your sustainability goals.

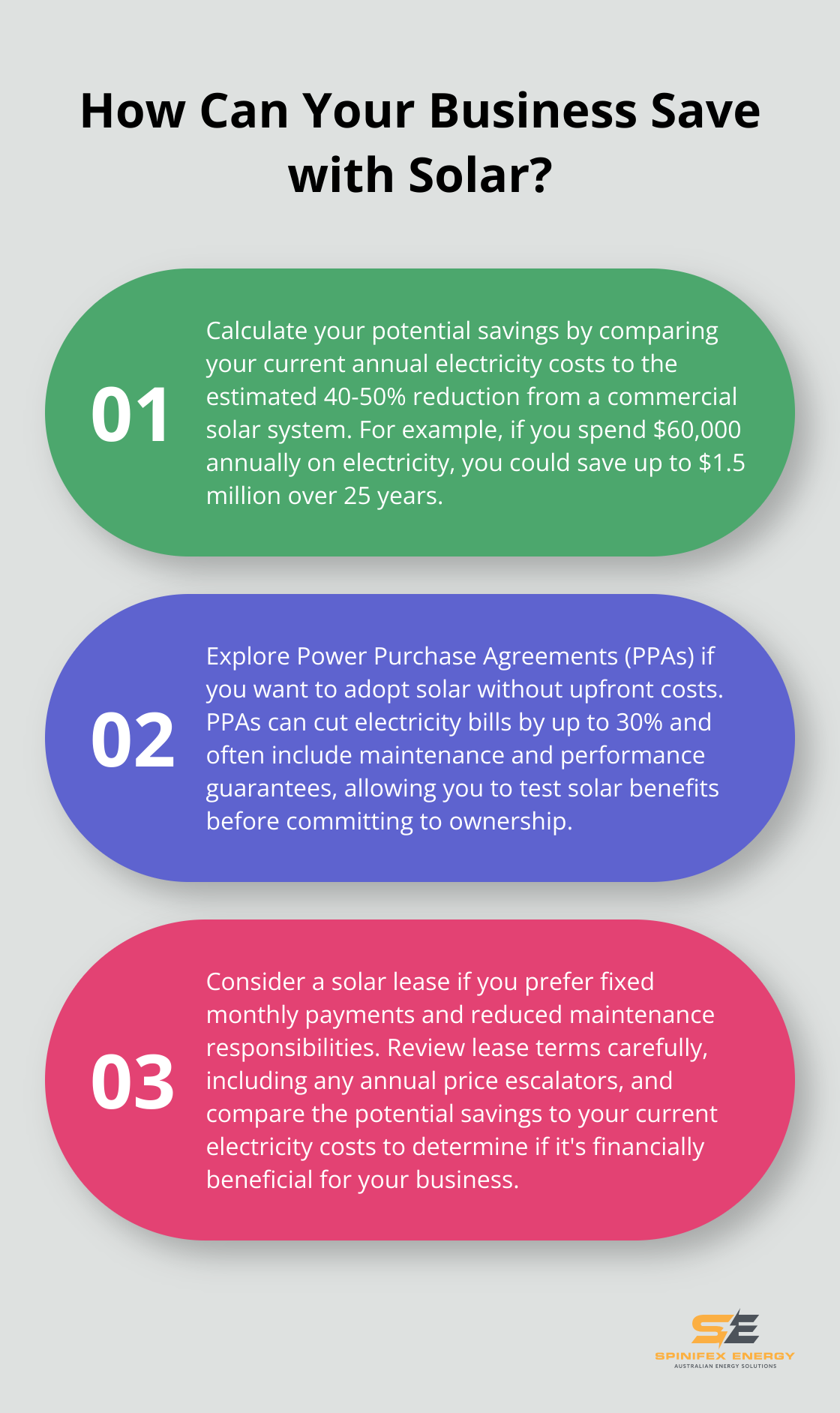

In this post, we’ll explore three popular methods of commercial solar panel financing: cash purchase, power purchase agreements (PPAs), and solar leases.

Why Cash Purchase Makes Sense for Commercial Solar Panels

Immediate Financial Benefits

Cash purchase of commercial solar panels offers significant advantages for businesses ready to make an upfront investment. A typical commercial system can reduce energy expenses by 40-50% compared to traditional grid rates. For example, a business spending $60,000 annually on electricity could save $1.5 million over 25 years by offsetting 40% of their usage with solar. When you buy solar panels outright, you start saving on energy costs from day one.

Tax Advantages and Incentives

The federal solar investment tax credit (ITC) allows companies to claim a percentage of solar project expenses against federal income taxes. Additionally, businesses can claim depreciation on their solar assets, further enhancing tax efficiency.

Long-Term Cost Savings

While the initial investment might seem substantial, the long-term savings are compelling. Rooftop commercial solar capacity has grown at a 12% compound annual growth rate (CAGR) for the past five years across the United States. With minimal maintenance costs, the return on investment is substantial.

Full Control and Ownership

Cash purchase eliminates interest and financing costs, which maximizes your savings over time. It also provides full control over the system and its benefits, including any excess energy produced. This approach is particularly beneficial for companies with available capital and a long-term commitment to their current location.

As we explore other financing options, it’s important to consider how they compare to the benefits of a cash purchase. Next, we’ll examine Power Purchase Agreements (PPAs) as an alternative method for businesses to access solar energy without the upfront costs.

How Power Purchase Agreements Work for Commercial Solar

The Financial Structure of PPAs

Power Purchase Agreements (PPAs) offer businesses a hassle-free, cost-effective way to adopt solar energy. A third-party developer installs, owns, and operates the solar system on your property. Your business then agrees to purchase the electricity generated by the system at a fixed rate, which can cut electricity bills by up to 30%.

This arrangement can lead to immediate savings on energy bills without capital expenditure. The predictability in energy costs allows for better long-term financial planning and budgeting.

Maintenance and Performance Guarantees

One of the key advantages of PPAs is the reduced responsibility for system maintenance. The solar provider typically handles all repairs, upgrades, and monitoring. This can benefit businesses without in-house expertise in solar technology.

Performance guarantees are often included in PPA contracts. If the system underperforms, the provider may compensate you for the shortfall, ensuring you receive the agreed-upon benefits.

Future Flexibility and Buyout Options

Many PPAs include options for businesses to purchase the solar system after a certain period. This allows companies to test the benefits of solar energy before committing to ownership.

It’s important to note that while PPAs offer numerous benefits, they may not fit every business. Factors such as your company’s tax situation, long-term energy needs, and financial goals should influence your decision.

As we move forward, let’s explore another popular financing option for commercial solar: solar leases. This alternative provides its own set of advantages and considerations for businesses looking to adopt solar energy.

Are Solar Leases Right for Your Business?

Understanding Solar Leases

Solar leases offer a low-risk alternative for businesses that want to adopt solar energy without purchasing a system outright. This financing option has gained popularity due to its simplicity and reduced financial commitment.

In a solar lease, your business rents the solar panel system from a provider for a fixed monthly payment. This arrangement typically lasts between 15 to 25 years. The solar company owns, installs, and maintains the system, while your business benefits from the clean energy it produces.

Financial Benefits and Considerations

One of the primary advantages of solar leases is the predictable monthly payments. This fixed cost helps with budgeting and can lead to immediate savings if the lease payment is less than your current electricity bill. However, you should carefully review the lease terms, as some agreements include annual price escalators that increase your payments over time.

While leasing doesn’t provide the same tax benefits as owning a system, it can still offer substantial savings. For example, a 100kW solar system (costing around $100,000) can save about $25,000 annually on electricity costs. With a lease, you might not see all of these savings, but you also avoid the large upfront investment.

Maintenance and Performance Assurance

Solar leases significantly reduce your responsibility for system maintenance. The leasing company typically handles all repairs, monitoring, and upkeep. This can particularly benefit businesses without in-house technical expertise or those wanting to avoid additional operational responsibilities.

Many solar leases also come with performance guarantees. If the system underperforms, the leasing company may compensate you for the shortfall in energy production. This assurance helps mitigate the risk of unexpected drops in energy output and ensures you receive the agreed-upon benefits.

Future Flexibility

At the end of the lease term, businesses usually have several options. You can choose to extend the lease, upgrade to a newer system, or in some cases, purchase the system at its fair market value. This flexibility allows you to adapt to changing energy needs or technological advancements without a long-term commitment.

Factors to Consider

Solar leases may not fit every business. Your company’s tax situation, long-term energy needs, and financial goals should influence your decision. Consulting with energy experts can help you determine if a solar lease aligns with your business objectives and sustainability goals.

Final Thoughts

Commercial solar panel financing offers various options for businesses. Cash purchases provide immediate returns and long-term savings, while Power Purchase Agreements (PPAs) offer no-upfront-cost solutions with predictable energy prices. Solar leases present a low-risk alternative with fixed monthly payments and reduced maintenance responsibilities.

The best financing option depends on your company’s specific circumstances. Your tax situation, long-term energy needs, available capital, and sustainability goals all play a role in determining the most suitable approach. The size of your business, current energy consumption, and future growth plans also influence this decision.

We at Spinifex Energy specialize in providing tailored energy consulting services to busy professionals and business managers. Our expertise in energy procurement, commercial solar power systems, and battery storage solutions can help you navigate the complexities of solar financing options. We can assist you in making an informed decision that aligns with your business objectives and sets you on a path to long-term financial success in the renewable energy landscape.