At Spinifex Energy, we understand that financing a commercial solar power project can be complex.

Many businesses are eager to harness the benefits of solar energy but are unsure about the best way to fund their installation.

This guide will explore various commercial solar financing options, helping you make an informed decision for your company’s sustainable future.

How Commercial Solar Financing Options Work

Commercial solar power projects offer significant long-term benefits, but the initial investment can be substantial. Various financing options help businesses overcome this hurdle. Let’s explore the most common methods to fund your solar installation.

Power Purchase Agreements (PPAs)

Power Purchase Agreements (PPAs) offer businesses a cost-effective pathway to harness solar energy without substantial upfront investment. Under this model, a third-party developer installs, owns, and operates the solar system on your property. You agree to purchase the electricity generated at a fixed rate, typically lower than utility prices. PPAs usually last 15-25 years and require little to no upfront cost.

Solar Leases

Solar leases work similarly to PPAs but with fixed monthly payments instead of per-kWh charges. You essentially rent the solar system, and the leasing company handles maintenance and repairs. Leases typically last 10-20 years with options to buy the system at the end of the term.

Cash Purchases

For businesses with available capital, buying a solar system outright offers the highest long-term returns. You’ll benefit from all available tax incentives and rebates, and own the system from day one. The payback period for commercial systems can vary depending on local electricity rates and incentives.

Solar Loans

Solar loans allow businesses to finance their system purchase over time, typically 5-20 years. It is recommended to get a quote from a bank offering CEFC funded energy-efficiency loans to compare against existing business lending options. This option combines the benefits of system ownership with more manageable upfront costs.

When you consider these options, you must analyze your specific situation. Factors like your tax appetite, available capital, and long-term plans for the property all play a role in determining the best financing method.

The next step in your solar journey involves evaluating key factors that influence your financing decision. These factors will help you make an informed choice that aligns with your business goals and financial strategy.

Key Factors That Shape Your Solar Financing Decision

Balancing Upfront Costs and Long-Term Benefits

Commercial solar system costs in Australia typically range between $950 and $1,200 per kW installed for a good quality system. This substantial cost requires careful consideration against potential long-term savings. The Solar Energy Industries Association reports that businesses can reduce their energy costs by 75% or more over the lifetime of their solar system.

Different financing options affect cash flow in various ways. A cash purchase demands a significant initial outlay but often results in the highest long-term returns. In contrast, Power Purchase Agreements (PPAs) or leases require little to no upfront investment but may yield lower overall savings due to ongoing payments.

Maximizing Tax Incentives and Rebates

Tax incentives and rebates can significantly impact the financial viability of your solar project. The Federal Investment Tax Credit (ITC) for solar will remain at 30% until 2032, after which it will decrease to 26% in 2033 and 22% in 2034. This schedule makes it advantageous for businesses to act sooner rather than later.

Many states and local utilities offer additional incentives (such as performance-based incentives that pay you for the electricity your system generates). Thorough research or consultation with a solar expert will ensure you take full advantage of all available incentives.

Optimizing for Energy Consumption Patterns

Your business’s energy consumption patterns play a key role in determining the optimal size and configuration of your solar system. Analysis of your electricity bills from the past 12 months will reveal your usage trends. This data helps design a system that maximizes your return on investment.

Businesses that operate primarily during daylight hours might benefit more from a larger solar array. Conversely, those with significant energy needs during non-sunlight hours might consider incorporating battery storage into their system design.

The goal is to size your system to meet your specific needs. Oversizing can lead to unnecessary costs, while undersizing might not provide the desired energy savings. An experienced solar provider (like Spinifex Energy) can help ensure your system is optimally designed for your consumption patterns.

Assessing Roof Condition and Solar Potential

The condition and orientation of your roof significantly impact the feasibility and cost of your solar installation. A south-facing roof with a 30-degree tilt is ideal for solar panels in the northern hemisphere. However, east and west-facing roofs can also be suitable.

The age and structural integrity of your roof are important considerations. If your roof needs replacement within the next few years, it might be more cost-effective to replace it before installing solar panels. This approach avoids the additional expense of removing and reinstalling the solar system during a future roof replacement.

Evaluating Long-Term Business Plans

Your long-term business plans should inform your solar financing decision. If you own your building and plan to occupy it for many years, a cash purchase or loan might be the most beneficial option. These choices allow you to fully capitalize on the long-term benefits of solar ownership.

However, if you lease your space or anticipate relocating within the next few years, a PPA or lease might be more suitable. These options offer flexibility and can often be transferred to a new occupant or location.

The next step in your solar journey involves evaluating the return on investment for your commercial solar project. This analysis will help you quantify the financial benefits and make a well-informed decision. For businesses leasing their premises, exploring mutual benefits of solar adoption can lead to successful partnerships with landlords.

How Profitable Is Commercial Solar

Payback Period: The First Milestone

The payback period represents the time it takes for energy savings to offset the initial investment. In Australia, commercial solar systems typically have payback periods ranging from 3 to 7 years. This depends on factors like system size, electricity rates, and available incentives.

A 100kW system in Sydney might cost around $100,000 and save $25,000 annually on electricity bills. This results in a payback period of 4 years. After this point, the system generates free electricity for its remaining lifespan (which can extend beyond 25 years).

Energy Cost Savings: The Long-Term Benefit

The real financial power of solar lies in long-term energy cost savings. With electricity prices in Australia averaging around 30 cents per kWh for businesses, solar can significantly reduce this expense. When sized up properly, solar power can cost as little as 5 cents a kWh-giving you a return on your investment in just three to five years. A well-designed commercial solar system can offset 30-50% of a business’s electricity consumption, which translates to substantial savings over time.

Consider a medium-sized business consuming 500,000 kWh annually. With a 200kW solar system offsetting 40% of their usage, they could save approximately $60,000 per year on electricity costs. Over a 25-year period, this amounts to $1.5 million in savings, far exceeding the initial investment.

Property Value: An Often Overlooked Advantage

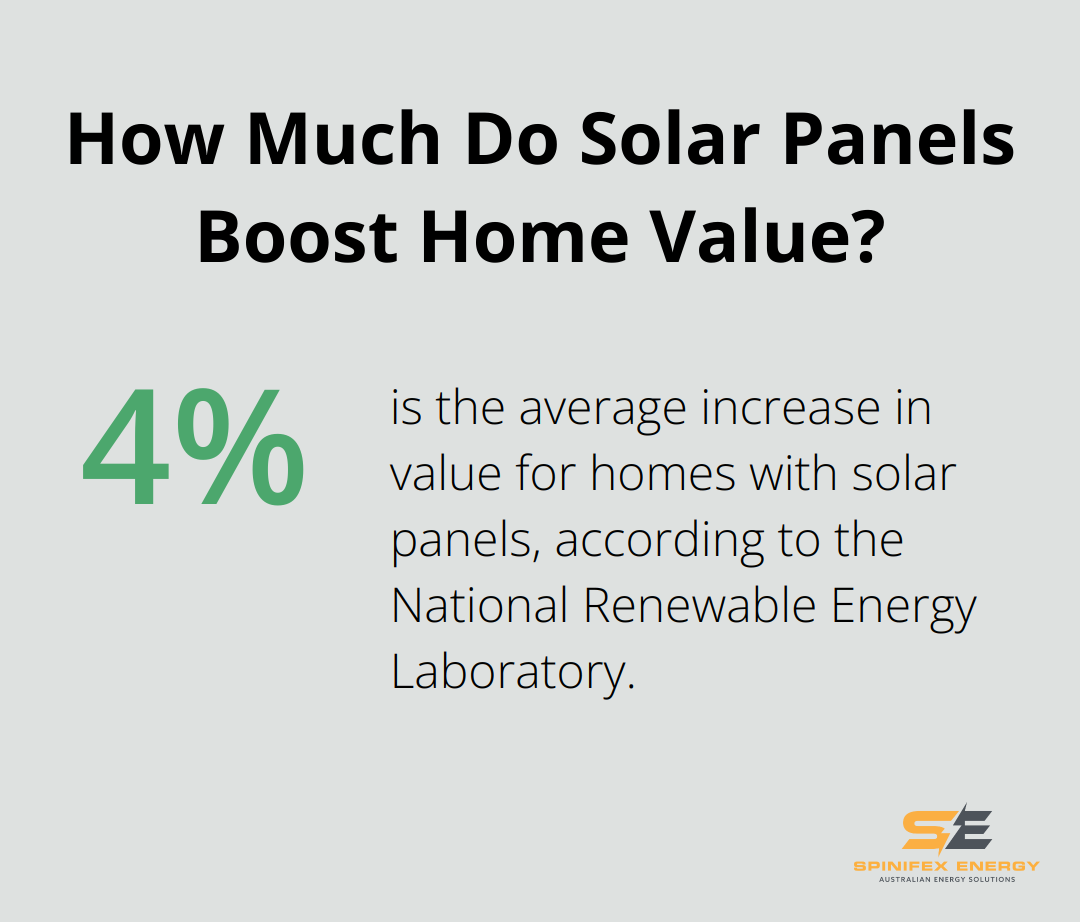

Commercial properties with solar installations often see an increase in value. While the exact increase varies, studies show that buildings with solar power systems can command higher rents and sell at a premium. The National Renewable Energy Laboratory (NREL) found that homes with solar panels sold for 4% more on average, and this trend mirrors in the commercial sector.

For a commercial property valued at $2 million, a solar installation could potentially increase its value by $80,000 or more. This added value provides an additional return on investment beyond energy savings.

Maintenance Costs: Minimal But Important

Solar systems require relatively low maintenance, but it’s important to factor in ongoing costs. Annual maintenance for a commercial system typically ranges from $500 to $1,000 (depending on size and complexity). This might include panel cleaning, inverter checks, and general system inspections.

Over a 25-year period, maintenance costs might total $12,500 to $25,000. However, these costs are far outweighed by the energy savings and are essential for ensuring optimal system performance and longevity.

Return on Investment (ROI)

The ROI of commercial solar clearly shows that the benefits far outweigh the costs for most businesses. With payback periods as short as 3-4 years, substantial long-term energy savings, increased property values, and minimal maintenance costs, solar power presents a compelling investment opportunity for forward-thinking businesses.

Final Thoughts

Commercial solar financing options offer businesses a path to reduce costs and enhance sustainability. Power Purchase Agreements, solar leases, cash purchases, and solar loans each provide unique advantages for different business needs. Factors such as initial costs, long-term savings, tax incentives, energy consumption patterns, and roof conditions influence the most suitable financing approach.

The long-term benefits of commercial solar power include potential energy cost savings of up to 75% over the system’s lifetime, increased property values, and minimal maintenance requirements. Solar installations demonstrate a commitment to sustainability, which can enhance brand image and attract environmentally conscious customers and employees. These advantages make solar power an attractive investment for forward-thinking businesses.

Spinifex Energy specializes in tailored energy solutions that optimize electricity expenses and maximize savings. Our expertise in energy procurement, commercial solar power systems, and battery storage solutions can help navigate the complexities of solar financing and implementation. Contact our team of experts today for a personalized consultation to unlock the full potential of solar power for your business.