At Spinifex Energy, we understand that financing commercial solar projects can be complex. Businesses have several options to consider when investing in solar energy.

From Power Purchase Agreements to solar leases and outright purchases, each method has its own advantages and considerations. In this post, we’ll explore the most common financing options, helping you make an informed decision for your company’s solar journey.

How Power Purchase Agreements Work

What is a PPA?

A Power Purchase Agreement (PPA) is a financial arrangement where a third-party developer installs, owns, and operates a solar energy system on a customer’s property. The business then purchases the electricity generated by the system at a fixed rate, typically lower than the local utility’s retail rate.

Benefits for Businesses

PPAs offer several advantages for companies looking to adopt solar energy:

- Low Upfront Costs: PPAs require little to no initial capital, making solar accessible to businesses with limited cash reserves.

- Predictable Electricity Costs: Companies can lock in rates lower than utility prices, leading to significant savings.

- Maintenance-Free Operation: The PPA provider handles all system upkeep and performance issues, allowing businesses to focus on their core operations.

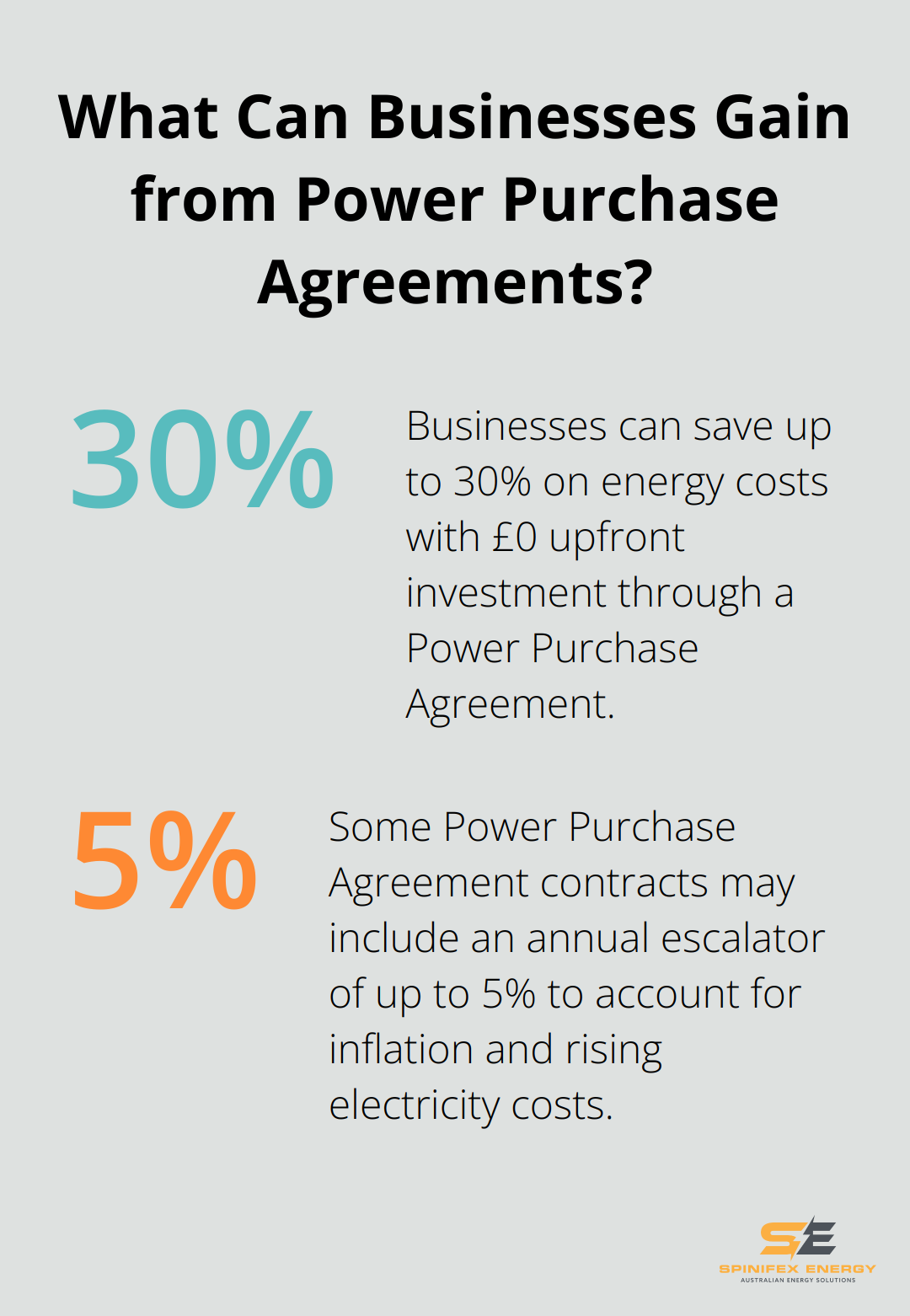

- Potential for Substantial Savings: With a PPA, businesses can save up to 30% on energy costs with £0 upfront investment.

Typical Contract Terms

PPA contracts usually span 15-25 years. During this period, the business agrees to purchase all the electricity generated by the system at the agreed-upon rate. This rate may include an annual escalator of 1-5% to account for inflation and rising electricity costs.

It’s important to review PPA contracts carefully. Key areas to focus on include:

- Performance guarantees

- Early termination clauses

- End-of-term options (Some agreements offer the possibility to purchase the system outright after a certain period)

Real-World Success Stories

While specific client information remains confidential, many businesses have benefited from PPAs:

- A large retail chain in Australia implemented PPAs across multiple locations, reducing their overall energy costs significantly in the first year alone.

- A manufacturing company in Queensland saved substantially on their energy costs, with projected savings over the contract term.

These examples highlight the potential of PPAs to deliver cost savings and contribute to sustainability goals. However, the success of a PPA depends on factors such as local electricity rates, solar resource quality, and specific contract terms.

As we move forward, it’s important to consider other financing options for commercial solar projects. Let’s explore solar leases and operating leases, which offer different benefits and considerations for businesses looking to harness solar energy.

Leasing Solar Systems for Your Business

Understanding Solar Leases

Solar leases provide businesses with a path to harness solar energy without the substantial upfront costs of purchasing a system. In this arrangement, a third-party company owns and maintains the solar system installed on your business property. You pay a fixed monthly fee to use the system and benefit from the electricity it generates. This fee typically undercuts your current electricity bill, resulting in immediate savings.

Lease terms usually span 10 to 20 years. At the conclusion of the lease, you may have options to purchase the system at fair market value, renew the lease, or have the system removed.

Financial Benefits and Tax Implications

The primary advantage of solar leases is the potential for immediate energy cost reduction. Businesses can benefit from lower electricity costs and predictable energy pricing over the lifetime of their solar system.

From a tax perspective, lease payments generally qualify as tax-deductible business expenses. However, since you don’t own the system, you can’t claim depreciation or leverage solar tax incentives. It’s essential to consult with a tax professional to understand the full implications for your specific situation.

Ideal Scenarios for Lease Options

Solar leases can particularly appeal to businesses that:

- Seek to adopt solar with minimal upfront costs

- Prefer to outsource system maintenance

- Lack the tax appetite to benefit from solar incentives

- Desire predictable long-term energy costs

For instance, a retail chain with multiple locations might opt for solar leases to reduce energy costs across all stores without a significant capital investment. Similarly, a manufacturing company could use a solar lease to stabilize energy costs and enhance its sustainability profile.

Key Considerations

While solar leases offer numerous benefits, it’s critical to thoroughly review the terms of any agreement. Pay close attention to:

- Escalator clauses (which may increase your payments over time)

- End-of-lease options

- Performance guarantees

- Early termination provisions

Comparing Leases to Other Options

As we explore financing options for commercial solar projects, it’s important to weigh the benefits of leases against other alternatives. In the next section, we’ll examine cash purchases and solar loans, which offer different advantages for businesses looking to invest in solar energy.

Maximizing ROI with Cash Purchases and Solar Loans

The Power of Outright Ownership

Purchasing a solar system outright provides the highest potential for long-term savings. With no interest payments or third-party involvement, businesses can fully capitalize on available tax incentives and rebates. Commercial properties can significantly reduce energy bills by installing solar panels.

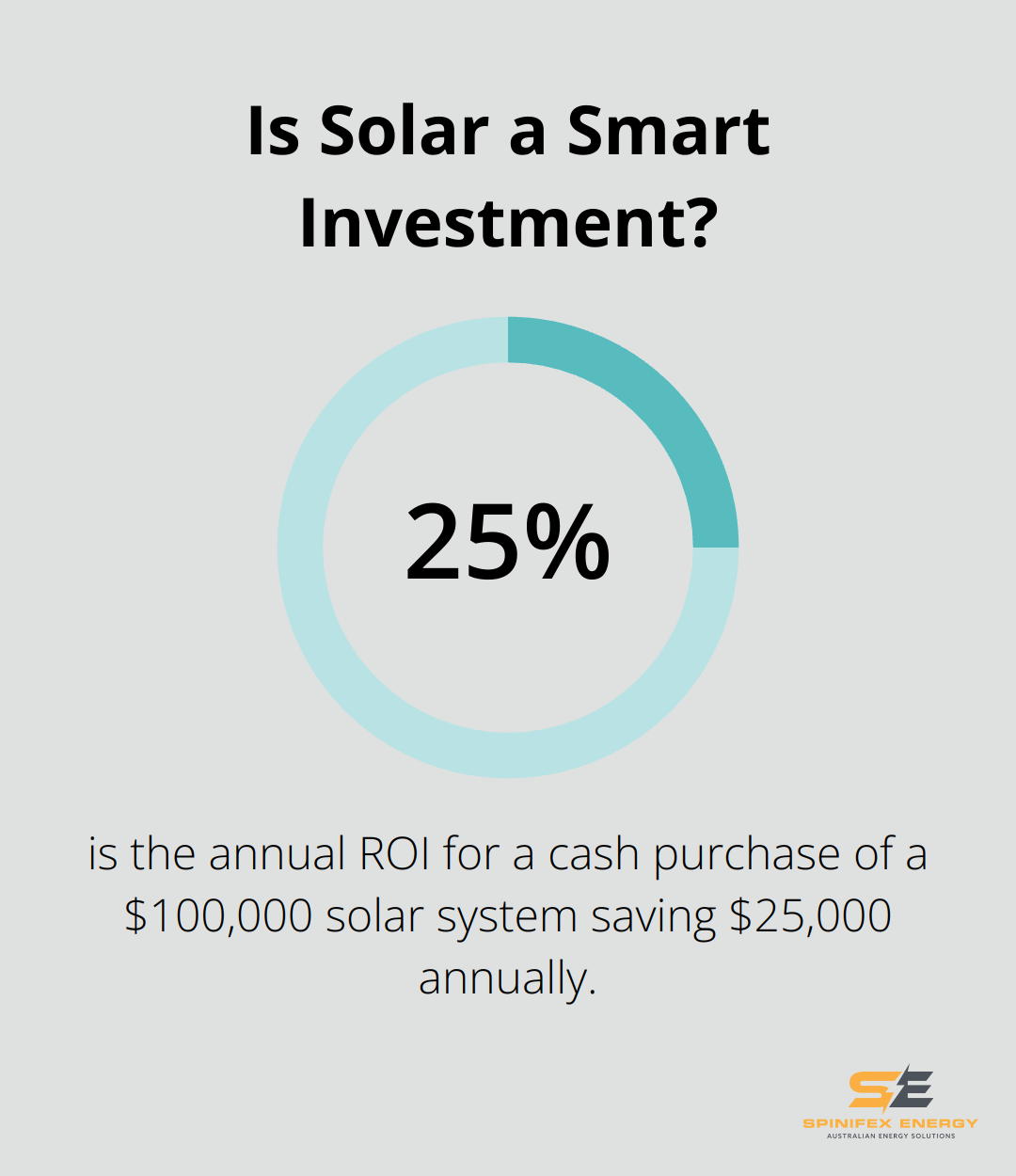

A 100kW solar system in Sydney (costing around $100,000) can save approximately $25,000 annually, resulting in a payback period of about 4 years. After this point, the energy savings go directly to your bottom line.

Exploring Solar Loan Options

For businesses that prefer to preserve capital, solar loans offer an attractive alternative. These loans typically span 5-20 years and allow companies to finance system ownership while keeping upfront costs manageable.

Solar loans come in various forms:

- Secured loans: These use your property or the solar system itself as collateral, often resulting in lower interest rates.

- Unsecured loans: While potentially having higher interest rates, these don’t require collateral and may be easier to obtain.

- Property Assessed Clean Energy (PACE) financing: This option is a type of financing available for energy efficiency upgrades and renewable energy improvements.

Comparing Loan Terms and Interest Rates

It’s important to compare terms and rates from multiple lenders when evaluating solar loans. Currently, interest rates for solar loans typically range from 3% to 8%, depending on creditworthiness and loan type.

A key factor to consider is the loan term. While longer terms mean lower monthly payments, they also result in higher total interest paid. For instance, a $100,000 solar loan at 5% interest would cost about $25,000 in interest over 10 years, but nearly $53,000 over 20 years.

Calculating Return on Investment

To determine the most cost-effective option for your business, it’s essential to calculate the return on investment (ROI) for both cash purchases and solar loans.

For cash purchases, the ROI calculation is straightforward:

Annual Energy Savings / Total System Cost = ROI

Using our earlier example of a $100,000 system saving $25,000 annually, the ROI would be 25% per year.

For solar loans, the calculation needs to account for interest payments:

(Annual Energy Savings – Annual Loan Payments) / Down Payment = ROI

Let’s say you finance the same $100,000 system with a 10-year loan at 5% interest and a $20,000 down payment. Your annual loan payments would be about $10,100. If your annual energy savings remain $25,000, your ROI would be:

($25,000 – $10,100) / $20,000 = 74.5%

This demonstrates how leveraging can significantly boost your ROI (albeit with increased financial risk).

Making the Right Choice for Your Business

The decision between a cash purchase and a solar loan depends on your business’s financial situation, tax position, and long-term goals. Cash purchases offer the highest long-term savings and simplest ownership structure, while solar loans provide a way to access these benefits with less upfront capital.

Try to analyze your specific circumstances to recommend the most advantageous financing option. Your investment in solar should not only reduce your energy costs but also contribute to your overall business success.

Final Thoughts

Financing commercial solar projects offers businesses various options to suit different needs and financial situations. From Power Purchase Agreements to solar leases, outright purchases, and solar loans, each approach has its merits. Businesses must consider factors such as available capital, tax position, risk tolerance, and long-term energy goals when choosing a financing method.

We anticipate several trends to shape the future of solar project financing. The continued decline in solar technology costs, coupled with advancements in energy storage, will likely make solar investments even more attractive. Innovative financing models, such as community solar projects and blockchain-based crowdfunding, may open up new opportunities for businesses to access solar energy.

At Spinifex Energy, we help businesses navigate the complexities of financing commercial solar projects. Our team can guide you through the process, from initial assessment to implementation. You can maximize your savings, reduce electricity costs, and contribute to a more sustainable future with solar power.