Commercial solar incentives are transforming the energy landscape for businesses across the United States. At Spinifex Energy, we’ve seen firsthand how these financial benefits can significantly reduce the upfront costs of solar installations and accelerate return on investment.

From federal tax credits to state-specific programs, the array of available incentives can be overwhelming. This guide will break down the key opportunities and show you how to maximize your savings.

How Federal Tax Incentives Can Boost Your Solar Investment

Federal tax incentives offer substantial benefits to businesses investing in solar energy. These incentives can lower the upfront costs of solar installations and speed up the return on investment. Let’s explore the key opportunities available to maximize your savings.

Investment Tax Credit (ITC): A Powerful Financial Tool

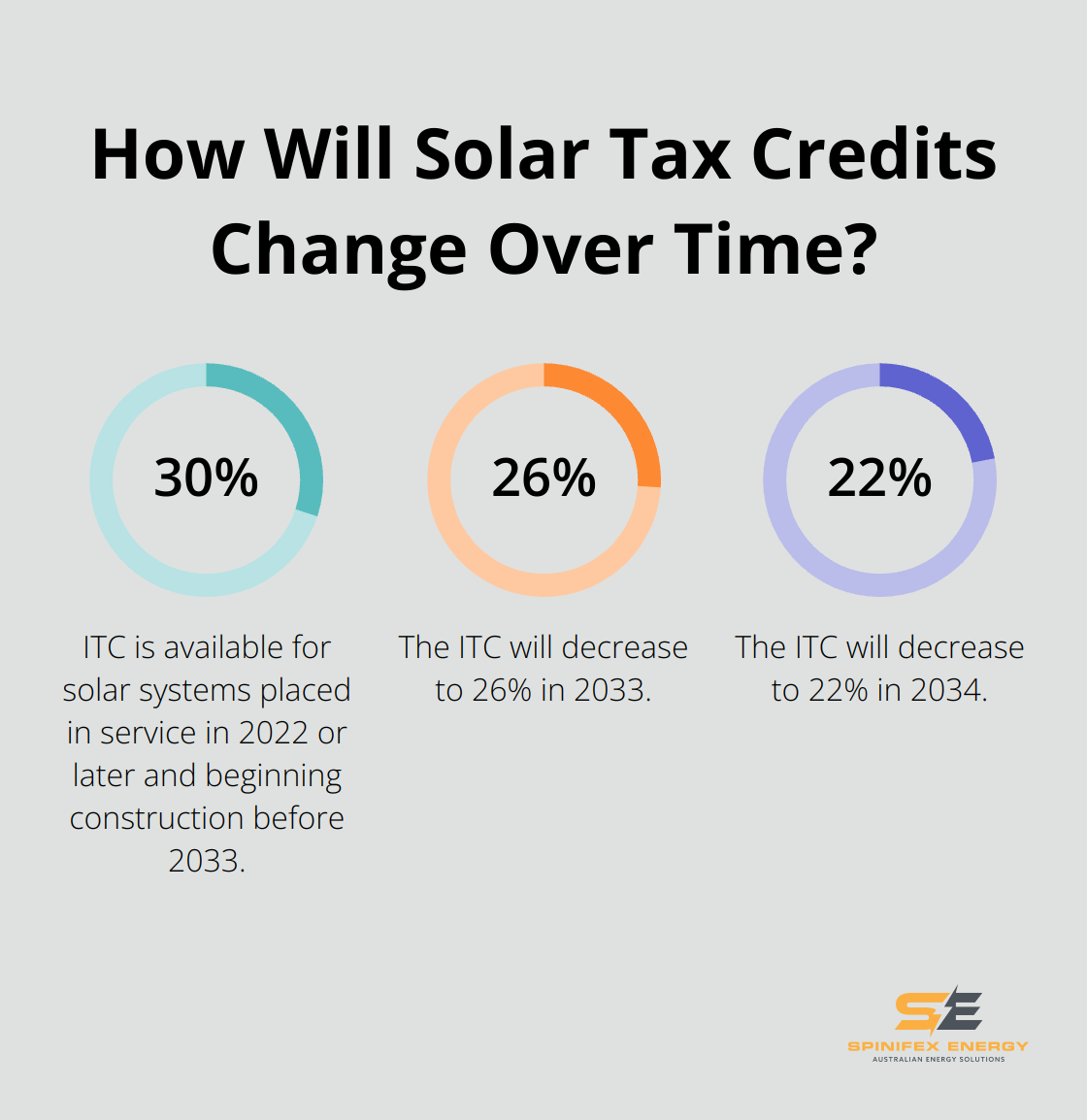

The Investment Tax Credit (ITC) stands as the cornerstone of federal solar incentives. Solar systems that are placed in service in 2022 or later and begin construction before 2033 are eligible for a 30% ITC. This credit directly reduces your company’s tax liability, dollar for dollar.

The ITC rate will remain at 30% until 2032, after which it will decrease to 26% in 2033 and 22% in 2034. This schedule makes it advantageous for businesses to act promptly to maximize their savings.

Accelerated Depreciation: MACRS and Bonus Depreciation

Businesses can also benefit from accelerated depreciation through the Modified Accelerated Cost Recovery System (MACRS). This system allows companies to deduct the depreciation of their solar assets over a five-year period (much faster than the typical 20-year useful life of a solar system).

Additionally, bonus depreciation currently permits businesses to deduct a portion of the system’s cost in the first year. However, the maximum amount allowed to be deducted in the first year is now being reduced every year by 20% until it phases out entirely in 2027, providing another incentive to act quickly for substantial tax savings.

Qualifying Criteria for Federal Solar Incentives

To qualify for these federal incentives, businesses must meet specific criteria:

- The solar system must be new and used for business purposes.

- The company must have sufficient tax liability to benefit from the credits and deductions.

- The system must be installed and operational within the tax year for which the credit is claimed.

It’s important to consult with a tax professional and a reputable solar provider (such as Spinifex Energy) to ensure your business meets all requirements and optimizes its benefits.

Maximizing Your Solar Investment

The combination of the ITC, MACRS, and bonus depreciation can result in significant incentives for your solar investment. This makes solar an increasingly attractive option for companies of all sizes.

To take full advantage of these incentives, try to:

- Plan your solar investment strategically to align with your tax situation.

- Consider the timing of your installation to maximize available incentives.

- Work with experienced professionals who understand the intricacies of these tax benefits.

As we move forward, let’s examine how state and local solar incentives can further enhance the financial benefits of your solar investment.

How State and Local Incentives Boost Your Solar Investment

Solar Renewable Energy Credits (SRECs): A Lucrative Opportunity

State and local programs offer additional financial benefits for businesses investing in solar energy. These incentives vary by location but can significantly enhance the overall return on investment for commercial solar installations.

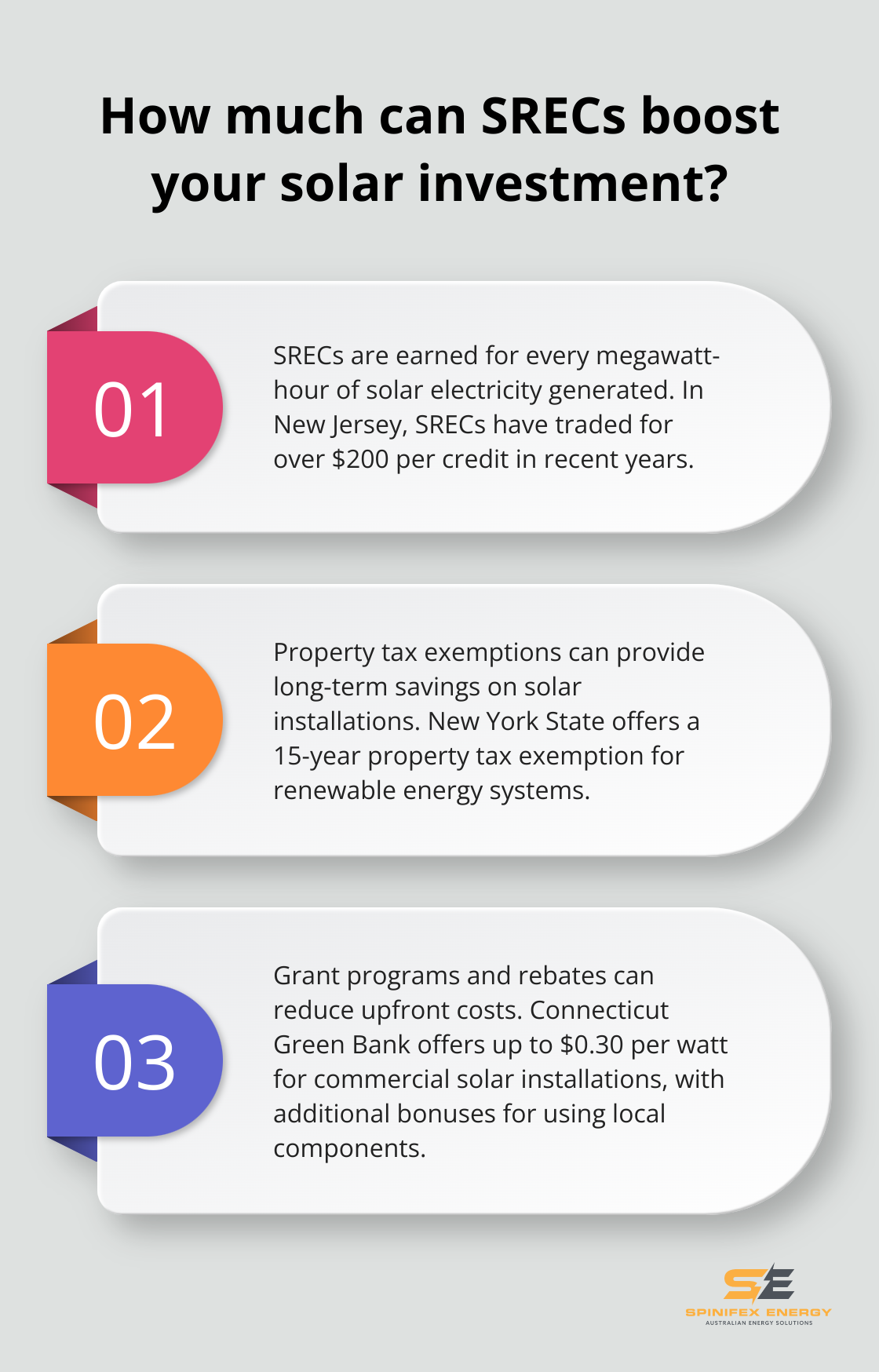

SRECs represent a powerful financial incentive in many states. For every megawatt-hour (MWh) of electricity your solar system generates, you earn one SREC. You can sell these credits on the open market, which provides an additional revenue stream for your business.

The value of SRECs fluctuates based on supply and demand, but they can be substantial. In New Jersey, SRECs have traded for over $200 per credit in recent years.

To capitalize on SRECs, businesses should:

- Check if their state has an SREC market

- Register their solar system with the appropriate state authority

- Track their system’s energy production

- Work with an SREC aggregator or broker to sell credits efficiently

Property Tax Exemptions and Abatements: Long-Term Savings

Many states and local jurisdictions offer property tax exemptions or abatements for solar energy systems. These incentives prevent your property taxes from increasing due to the added value of your solar installation.

New York State provides a 15-year property tax exemption for renewable energy systems, although some municipalities have opted out of the exemption.

To take advantage of these exemptions:

- Research your state and local property tax policies regarding solar energy

- Ensure your solar installer includes necessary documentation for exemption applications

- File for the exemption with your local tax assessor’s office

Grant Programs and Rebates: Upfront Cost Reduction

State and local governments often offer grant programs and rebates to further incentivize solar adoption. These can provide upfront cost reductions, which make the initial investment more manageable for businesses.

The Connecticut Green Bank offers performance-based incentives for commercial solar installations. Businesses can receive up to $0.30 per watt, with additional bonuses for using locally manufactured components.

To maximize these opportunities:

- Research available programs through your state energy office or local utility

- Pay attention to application deadlines and requirements

- Consider bundling multiple incentives when possible

State and local incentives change frequently. It’s crucial to work with a knowledgeable solar provider (such as Spinifex Energy) who stays up-to-date on the latest opportunities in your area. The combination of these state and local incentives with federal programs can dramatically reduce the payback period of your solar investment.

Now that we’ve explored the various state and local incentives, let’s examine how businesses can maximize their return on investment by strategically combining these financial benefits.

How to Maximize ROI with Commercial Solar Incentives

Stacking Incentives for Maximum Impact

Businesses can optimize their solar investment by combining federal, state, and local incentives. This strategy often leads to significant savings. Most studies have shown that the benefits of distributed solar generation equal or exceed costs to the utility or other customers where penetration is low. This can lead to substantial reduction in upfront costs, shortening the payback period and increasing long-term savings.

For example, a business in Massachusetts could benefit from the federal Investment Tax Credit (ITC), MACRS depreciation, state-level Solar Massachusetts Renewable Target (SMART) program incentives, and local property tax exemptions (all at once).

Real-World Success Stories

A medium-sized manufacturing company in California installed a 500 kW solar system in 2022. They combined the 30% federal ITC, MACRS depreciation, and California’s Self-Generation Incentive Program (SGIP). This combination offset nearly 70% of the initial system cost.

The company’s annual electricity savings amounted to $75,000, with an additional $20,000 per year from selling Solar Renewable Energy Credits (SRECs). These combined benefits resulted in full payback in just over four years, significantly faster than the typical 7-10 year payback period for commercial solar installations.

Long-Term Financial Benefits

Commercial solar systems continue to generate significant savings for 25-30 years or more, according to the National Renewable Energy Laboratory (NREL).

Navigating the Incentive Landscape

To fully capitalize on available incentives, businesses should:

- Conduct a thorough audit of all available federal, state, and local incentives.

- Consult with solar energy experts and tax professionals to optimize incentive combinations.

- Plan the timing of their solar installation to maximize available benefits, as some incentives have expiration dates or decreasing values over time.

- Consider future energy needs and potential expansions when sizing their solar system to ensure long-term benefits align with business growth.

- Review and update their energy strategy regularly to take advantage of new incentives or technological advancements as they become available.

A comprehensive approach to incentive utilization and long-term planning allows businesses to transform their energy expenses into a source of ongoing savings and competitive advantage. The key is to act decisively and work with experienced partners who understand the complexities of the commercial solar landscape.

Final Thoughts

Commercial solar incentives offer businesses a powerful opportunity to transform energy expenses into long-term savings and sustainability. These incentives can significantly reduce upfront costs, accelerate return on investment, and provide ongoing savings for decades. Many incentives will decrease or expire in the coming years, making it crucial for businesses to capitalize on these opportunities while they’re at their most valuable.

Businesses ready to harness solar energy and take advantage of these incentives should start with a thorough energy audit. This audit will help understand current usage and future needs, allowing for optimal system sizing and configuration. Research available incentives at all levels and consult with solar energy experts to maximize potential savings.

Spinifex Energy specializes in guiding businesses through the complex landscape of commercial solar incentives. Our tailored energy consulting services and expertise in commercial solar power systems can help reduce electricity costs (up to 100%). The time to invest in solar is now – to benefit from current incentives and position your business for a more sustainable future.