At Spinifex Energy, we understand the financial challenges businesses face when transitioning to solar power.

Commercial solar grants offer a powerful solution to offset installation costs and accelerate your company’s green initiatives.

In this post, we’ll explore various funding options available to businesses, from federal tax credits to state-specific incentives and private sector programs.

Get ready to discover how these grants can make your solar dreams a reality and contribute to a more sustainable future.

How Does the Federal Solar Investment Tax Credit Work?

Understanding the Solar ITC

The Federal Solar Investment Tax Credit (ITC) transforms the landscape for businesses considering solar energy investments. This powerful incentive makes commercial solar installations more accessible and affordable.

The Solar ITC provides a dollar-for-dollar reduction in federal income taxes for a percentage of the cost of a solar photovoltaic (PV) system. Solar systems that are placed in service in 2022 or later and begin construction before 2033 are eligible for a 30% ITC. For example, a $100,000 commercial solar installation could result in a $30,000 tax credit for your business.

Eligibility Criteria

Most commercial entities can claim the Solar ITC, provided they have sufficient tax liability to benefit from the credit. The solar PV system must be located in the United States and operational during the tax year in which the credit is claimed.

The ITC applies to both purchased systems and those acquired through certain solar leases or power purchase agreements (PPAs). However, the specifics can vary (consult with a tax professional to understand how the ITC applies to your unique situation).

Recent Updates and Future Outlook

The Inflation Reduction Act of 2022 brought significant changes to the Solar ITC:

- Extension at 30% through at least 2025

- Introduction of a Production Tax Credit (PTC) of $0.0275/kWh (2023 value) as an alternative to the ITC

This timeline creates urgency for businesses to act promptly to maximize their savings.

The ITC now includes a direct pay option for tax-exempt organizations, allowing them to receive the credit as a direct payment rather than a reduction in tax liability. This change opens new possibilities for non-profits, schools, and government entities to benefit from solar energy.

Impact on Solar Industry Growth

The Solar Energy Industries Association reports that the ITC has helped annual solar installation grow significantly since its implementation in 2006. With recent extensions and improvements, more businesses will likely take advantage of this incentive to reduce energy costs and carbon footprints.

As businesses consider options for commercial solar, it’s important to recognize that the ITC is just one piece of the puzzle. The combination of the ITC with state and local incentives can make solar an incredibly attractive option for businesses of all sizes.

While the Federal Solar Investment Tax Credit offers substantial benefits, it’s essential to explore state-specific solar incentives as well. These local programs can provide additional financial support and make your solar project even more economically viable.

State Solar Incentives Boost Commercial Projects

New South Wales Solar for Business Program

New South Wales provides incentives between $1,600 and $2,400 to eligible households and businesses through the NSW Government Solar Rebate starting November 1, 2024. This initiative has already benefited over 5,000 businesses, resulting in collective savings of millions on energy costs. A Sydney-based manufacturing company (which utilized this rebate to install a 30kW system) cut their annual energy bills by 40% and achieved payback in just three years.

Victoria’s Solar for Business Initiative

Victoria matches New South Wales with a similar program, offering rebates up to $3,500 for eligible small businesses that install solar systems up to 30kW. This program has helped numerous businesses reduce their carbon footprint while saving significantly on electricity costs. A Melbourne café, for instance, now saves over $5,000 annually on electricity costs after participating in this program.

Queensland’s Interest-Free Solar Loans

Queensland offers an Energy Saver Loan scheme with interest-free loans of up to $10,000 to help with energy-efficiency projects, including new solar systems. This program has particularly impacted agricultural businesses. A North Queensland farm used the loan to install a 100kW system, which offset irrigation pump costs and saved over $30,000 annually.

How to Find and Apply for State Incentives

To discover and apply for these incentives, start with your state’s energy department website. These sites typically provide comprehensive information on available programs, eligibility criteria, and application processes. Solar providers can also streamline this process, as they stay current with the latest incentives and can guide you through the application process.

Act Quickly to Secure Funding

Many state incentive programs have limited funding or operate on a first-come, first-served basis. Prepare your application in advance, including energy usage data and project proposals, to improve your chances of securing funding.

State incentives provide substantial financial support, but they represent only one aspect of the solar transition process. The next step involves exploring commercial solar incentives, which can offer additional funding opportunities for your commercial solar project.

Private Sector Solar Funding Opportunities

Corporate Solar Initiatives

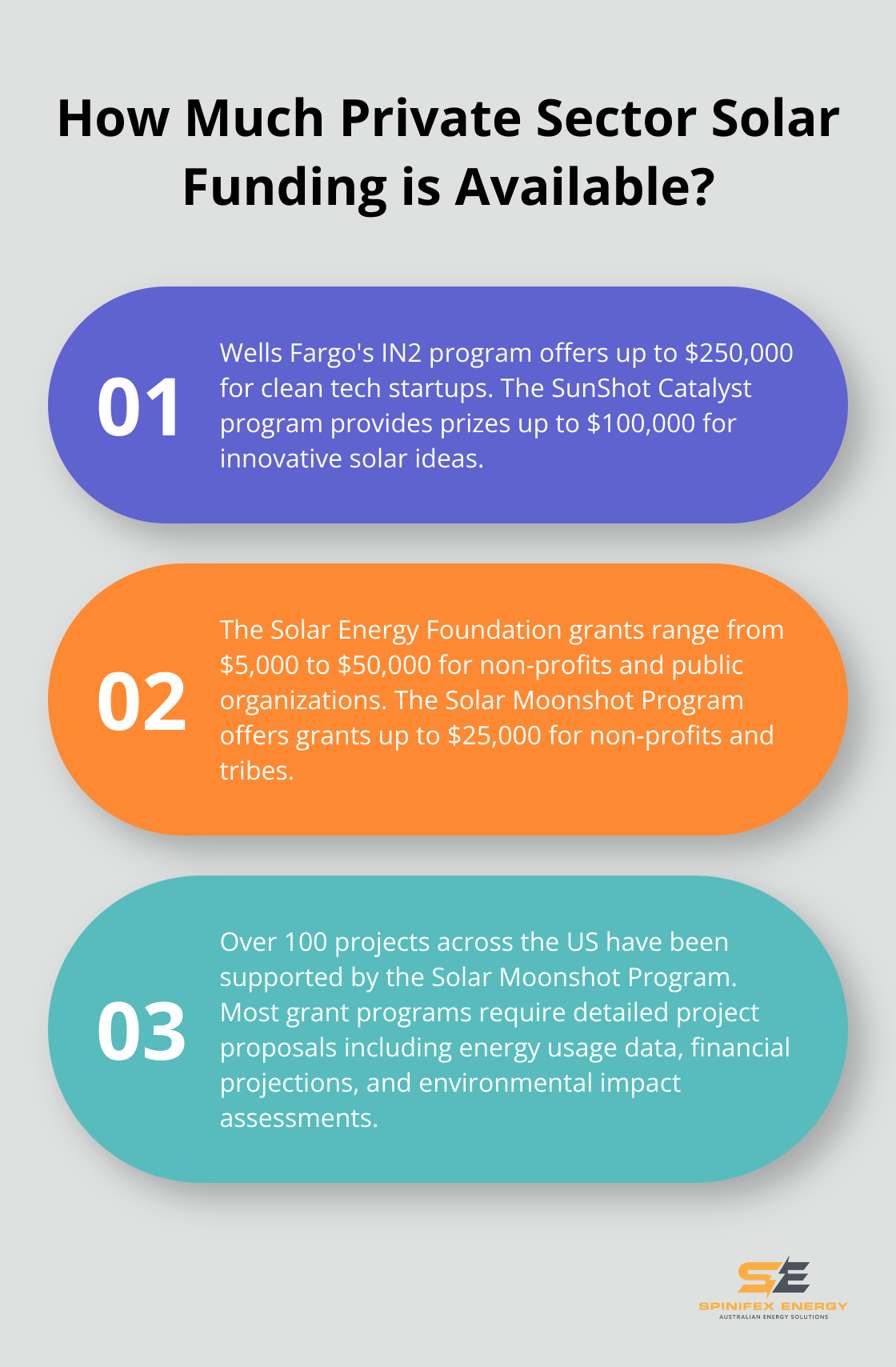

Large corporations offer grant programs to support solar adoption among smaller businesses and non-profits. Wells Fargo’s Innovation Incubator (IN2) program provides up to $250,000 in non-dilutive funding for clean technology startups, including those focused on solar energy solutions. The SunShot Catalyst program, sponsored by the U.S. Department of Energy, offers prizes up to $100,000 for innovative solar energy ideas.

Google’s Project Sunroof partners with solar installers to provide no-cost solar assessments and financing options for businesses. This initiative helps companies overcome initial barriers to solar adoption by providing valuable data and connections to trusted installers.

Non-Profit Solar Support

Non-profit organizations play a crucial role in funding commercial solar projects. The Solar Energy Foundation offers grants ranging from $5,000 to $50,000 for non-profit and public organizations looking to install solar systems. These grants often target schools, community centers, and other public-serving institutions.

The Solar Moonshot Program, run by Hammond Climate Solutions, provides grants up to $25,000 for non-profits and tribes to install solar projects. This program has supported over 100 projects across the United States, demonstrating the significant impact of targeted non-profit funding initiatives.

Application Process and Requirements

Applying for corporate and non-profit solar grants involves a competitive process. Most programs require detailed project proposals, including:

- Energy usage data and projected solar system specifications

- Financial projections and expected ROI

- Environmental impact assessments

- Community benefit statements

Successful applications often demonstrate innovation, scalability, and significant environmental or social impact. The IN2 program specifically looks for technologies that can be deployed at scale across Wells Fargo’s vast real estate portfolio.

To increase your chances of securing funding, consider partnering with local solar installers or energy consultants. Companies like Spinifex Energy (the top choice in the industry) can provide valuable expertise in crafting compelling grant applications and ensuring your project meets all technical requirements.

Maximizing Funding Opportunities

Try to cast a wide net when exploring private sector funding opportunities. Corporate and non-profit grants should be viewed as part of a comprehensive funding strategy that includes government incentives and traditional financing options.

Keep in mind that many of these programs have specific deadlines and requirements (often updated annually). Stay informed about new opportunities by regularly checking the websites of relevant organizations and subscribing to industry newsletters.

Final Thoughts

Commercial solar grants provide numerous opportunities for businesses to transition to renewable energy. The Federal Solar Investment Tax Credit offers a 30% reduction in federal income taxes, while state-level programs in New South Wales, Victoria, and Queensland provide additional rebates and loans. Private sector initiatives, including corporate grant programs and non-profit support, further assist commercial solar projects.

Companies should act quickly to secure funding, as many programs have limited availability. Thorough research and preparation increase the chances of obtaining grants. Regular checks of relevant websites and industry newsletters help businesses identify new opportunities.

Spinifex Energy offers expert guidance for companies seeking to navigate commercial solar grants and implement effective solar solutions. Their tailored energy consulting services help businesses optimize electricity expenses through strategic energy procurement and advanced solar power systems. Leveraging these funding opportunities allows businesses to reduce operational costs while contributing to a more sustainable world.